- Learn

- Invest

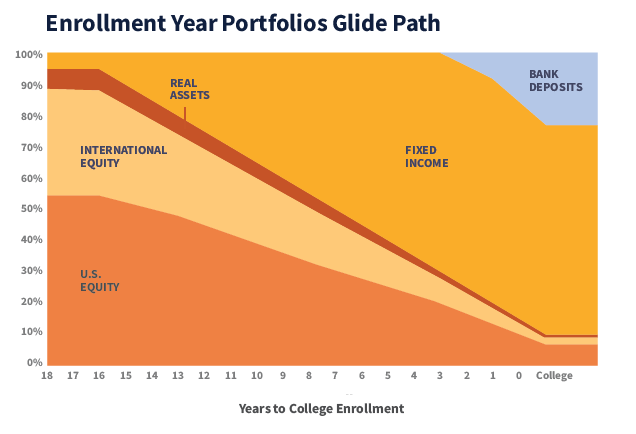

Enrollment Year Portfolios

Stay on track for school.

The Enrollment Year Portfolios are designed to allow you to select a Portfolio based upon the year your Beneficiary is expected to enroll in school or the year in which you expect to withdraw funds (the “Enrollment Year”), and your risk tolerance. An Enrollment Year Portfolio’s target allocations will change as your Beneficiary approaches their Enrollment Year. For each Enrollment Year Portfolio (except the College Enrollment Portfolio), the investment allocation is adjusted quarterly during the term of the Enrollment Year Portfolio, through the Enrollment Year.

You may choose a more aggressive or conservative approach by designating a Portfolio that differs from the one corresponding to your Beneficiary’s expected enrollment date.

Passive Investment Options

Passive Enrollment Year

Passive Enrollment Year Portfolios primarily invest in underlying index funds. They are designed to allow you to select a Portfolio based upon the year your Beneficiary is expected to enroll in school or the year in which you expect to withdraw funds (the “Enrollment Year”), and your risk tolerance.

Stocks

Bonds

Cash

Blend Investment Options

Blend Enrollment Year

Blend Enrollment Year Portfolios invest in a combination of underlying actively managed and index funds. They are designed to allow you to select a Portfolio based upon the year your Beneficiary is expected to enroll in school or the year in which you expect to withdraw funds (the “Enrollment Year”), and your risk tolerance.

Stocks

Bonds

Cash

A word about risk: Keep in mind that you can lose money by investing in a portfolio. Each of the Age-Based, Enrollment Year, Static, and Individual Fund Portfolios involves investment risks, which are described in the Program Disclosure Statement and should be considered before investing. For example, international investing, especially in emerging markets, has additional risks such as currency fluctuation, economic and political risks, and market volatility. Investing in small, medium, and international companies may increase the risk of fluctuations in the value of your investment and involves greater risks than investing in more established companies. Portfolios that invest in specific industries or sectors, such as real assets, have industry concentration risk. As an example, the portfolios that invest in real assets may perform poorly during a downturn in the real assets industry.

Portfolios that invest in bonds are subject to risks such as interest rate risk, credit risk, and inflation risk. In particular, as interest rates rise, the prices of bonds will generally fall, which can impact performance. It is important to note that the value of your account will fluctuate with market conditions. When you withdraw funds, you may have more or less than your actual investment. For more information on the portfolios and the underlying funds in which they invest, see the Program Disclosure Statement.

Looking for something specific?

Open an Account with Your Financial Advisor

Get Started